Original Zhou Xueling’s research on going to sea in Yuanchuan

In recent years, the reputation of Japanese whisky has risen. Five years ago, the cheap whisky cost dozens of dollars, but now it costs more than 800 dollars. In 2005, the limited edition Yamazaki sold for $7,000 for 50 years, and in 2018, it was auctioned for $340,000. This increase will make Maotai cry for big brother.

▲ The record-breaking Yamazaki has turned 38 times in 13 years in 50 years.

However, just over a decade ago, Japanese whisky was just a neglected category, and Japanese manufacturers closed down one after another or sold themselves to foreign companies because of unsalable sales. No one expected that there would be today’s grand occasion.

So, is a bottle of Japanese whisky of several thousand dollars an IQ tax? How did it get fired to its current high position? What elements do you need for a wonderful marketing hype?

Let’s start with a conclusion. At this point, the price of Japanese whisky is far more than the drinking value, but it has financial attributes like assets such as houses, stocks and futures. Therefore, the analysis of its speculation path, just like the analysis of all financial assets that can be speculated, cannot be separated from four elements, namely:

A series of unique narratives that are generally accepted,

A handful of dealers with concentrated chips,

A large group of speculative hot money,

And an objective scarcity.

Here, you can pause and think about whether diamonds, Maotai, Bitcoin and school districts have all these four elements, or which one is missing.

Next, we will explain them in order to see how they create the myth of Japanese whiskey one by one.

| Narration

YCCHUHAI

The first is narrative, an infectious narrative can shape people’s cognition, and the unified cognition of a group of people is value. A group of people think that something is valuable, then it is valuable.

And if narrative is to be convincing and interesting, we should start from both rationality and sensibility.

Japanese whisky builds rational cognition by winning prizes. In 2001, a professional whisky magazine in Britain held a wine tasting contest. Among 293 whiskies sent by manufacturers, a whisky from Japan was rated as the first. In the same year, another Japanese whisky also won the gold medal in the internationally renowned liquor competition IWSC.

▲ Japanese whisky is emerging in Europe.

Write down these two test sites. I will take the test later. This is the first time that Japanese whisky beat Scotland on the international stage, and it began to gain the attention of European fans, and in the next 20 years, it continued to win large and small awards.

However, although there are more and more awards, there is a big difference between rational cognition and non-cognition. If there are more, it will be numb. Therefore, it is necessary to rely on perceptual cognition, like multiple dreams in Inception, to implant an idea into people’s hearts with a large number of stories.

The most widely circulated story of Riwei is the magical wooden cask with water.

The barrel used for traditional whisky is oak, which is not available in Japan. Generally, it was imported from North America and Europe. The supply was interrupted during World War II, so we had to look for local substitutes. Finally, we found the water wood in Hokkaido, which seemed to be a last resort at that time, because it was not well sealed, the original wine was easy to leak and volatilize, and the aroma released in the first few years overshadowed the wine, which was very poor. So as soon as the war was over and the supply of oak resumed, the winery immediately put this inferior barrel aside.

Unexpectedly, 20 years later, Riwei became a friend of time. People accidentally opened the wooden barrels of water from the abandoned warehouse and found that the strong taste of the past had become only a faint sandalwood and incense, full of mysterious oriental flavor. This underwater wood has become a unique feature of Japanese whisky.

This counter-attack story was relished by whisky lovers, and the aroma of water chestnut was introduced to Mengxin as the characteristic of Riwei, but I didn’t know that I was just a spreading node of the story.

So these are the means by which Riwei establishes rational and perceptual cognition. The most direct and effective way of rational cognition is to look for authoritative endorsement, and well-known events belong to this link. Perceptual cognition needs to get to the heart of human nature, like the unsuspecting water bucket finally winning. This reversal is just like Maotai’s counterattack from loss to national wine, which is a story that most people like to hear.

In addition, the story will tell you that the water used by Riwei is the mountain spring of Japanese tea ceremony, the brewery is located in the unique terrain and climate of Japan, and the filtering material is bamboo instead of peat.

It is true that these factors will lead to objective differences in taste, but such subtle differences, ordinary people drink, "tasted, but it seems that they have not tasted", and drink after accepting the above emotional narrative, "it is worthy of the taste of sandalwood, temples, bamboo forests and clear springs!"

However, how did this series of infectious narratives form and how did they get their first spread? This is the second element, the banker.

02 | banker

YCCHUHAI

When we say that there are bookmakers in a market, we mean that most of the chips are concentrated in the hands of a few people. Only by controlling most of the chips can the holder ensure that he will not make wedding clothes for others and have the incentive to invest in speculation. Just like De Beers, a diamond giant, is willing to spend a huge amount of advertising money to tell you that "diamonds will last forever" because it once monopolized 85% of the world’s diamond supply.

It is in this situation that Riwei took off. In 2010, there were only nine breweries in Japan, and nine were concentrated in the hands of several companies. Suntory alone accounted for the most famous three, compared with more than 130 in Scotland. Therefore, Japanese companies have the motivation to spread the story of Japanese whisky with great fanfare.

Suntory has brand ambassadors in all parts of the world, and spends nine months every year holding tasting meetings everywhere, telling the stories of mountain springs, climate and bamboo to whisky lovers, collectors and major association media over and over again, so these well-designed narratives can be spread all over the world.

If this example is not direct enough, then look back at this picture.

The third wine comes from the legendary distillery in Japan, Karuizawa. The distillery was shut down in 2000, but it left more than 300 barrels in stock. Since 2011, it has frequently appeared in the auction market, and in 2020, it was auctioned for 430,000 US dollars a bottle.

Then why did the cocktail party that had been shut down before suddenly spread all over Europe? Because the publisher of the magazine (the first one) that first recommended Japanese whiskey, in 2011, all the stocks of Karuizawa were sold, and Amway this wine began to spread to the European whisky circle.

This shows that Japanese whisky has long had enough gimmicks and strength, and there have long been people who know how to appreciate it and promote it, but it was not until this person became a banker that he was motivated to promote it for Karuizawa.

To sum up, around 2010, the domestic production of Japanese whisky was monopolized by several enterprises, and the overseas inventory was monopolized by one company, and the chips were quite concentrated. This represents that Riwei is a market with a bookmaker, so the internal motivation of story-telling speculation was found.

However, it is not enough to have a banker in a market. Only when a third party responds to your hype with real money can we prove to the spectators that this is not a banker’s entertainment, and we can really revitalize this market, attract more funds and form a snowball-like growth.

This third party, usually in the stock market, is called hot money.

03 | Hot money

YCCHUHAI

Japanese whisky has ushered in a number of professional hot money, the most representative of which is a private equity fund called Platinum Whiskey Investment Fund.

▲ When the fund is issued, promote the increase of whisky after 2011.

Specializing in such assets as single malt whisky. This fund was established in 2014, and in the following seven years, the annualized rate of return was 17%, which was as good as Kun Kun, who everyone loved.

One of the most profitable assets is 300 bottles of karuizawa aged for 30 years, and made a net profit of 300% after three years.

This is the continuation of the previous one. The hot money took the goods from the banker and responded to the banker’s shouting with real money. At the same time, the story of earning three times in three years has become another signboard, attracting more funds to concentrate in this market, forming a phenomenon that the more the price rises, the more the market buys it.

Of course, with stories, bookmakers and hot money, you can really hype up a myth of soaring in a short time, but it has been ten years since Japanese whisky emerged, and there must be a real factor supporting its price for a long time, and this is the last point we want to talk about, scarcity.

04 | scarcity

YCCHUHAI

Scarcity is the reason why buyers are willing to advance wave after wave to receive goods, and it is also the premise that hot money is willing to help bookmakers earn money, because no one wants to spend a lot of money to buy a rare baby, and it turns out that there is a steady supply of everything in the market.

Japanese whisky, on the other hand, has an objective guarantee in terms of scarcity, because the upper limit of annual wine production is determined by history.

For example, Yamazaki’s 18-year-old wine refers to the wine that has matured for more than 18 years, so the upper limit of the annual wine produced now depends on how much wine was brewed in the winery more than ten years or even decades ago. The previous 12 to 40 years, that is, from the 1980s to 2010, coincided with a whole period of Japanese whisky industry trough.

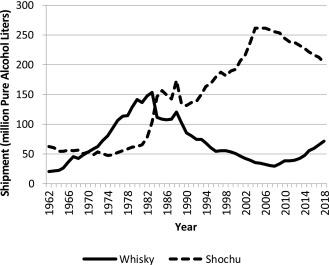

In Japan, the consumption of spirits basically consists of shochu and whisky. Before the 1980s, whisky was a symbol of successful professionals in Japan, while shochu was considered as a drink for the bottom of society. However, in the early 1980s, shochu was marketed to young people, and the low-end label was packaged as "Drinking shochu is a rebellion against the stereotype of the older generation", which occupied the minds of young consumers and made the sales of Japanese whisky drop by 15% for the first time in two years.

▲ The shipments of shochu and whisky reversed in the early 1980s.

The second blow came from scotch whisky. In the late 1980s, the European Commission started tariff negotiations with Japan, and Britain, a powerful country, first considered its own whisky export, which pushed Japan to significantly reduce the tariff on scotch whisky, making Japan lose its cost performance. When the new tariff was implemented in 1989, the sales of scotch whisky in Japan soared by 56%, while the sales of Japanese whisky were cut by half in five years.

The third blow came in the 1990s, when Japan’s economy was in decline for 10 years, followed by 20 years and 30 years … Anyway, the office workers waving 10,000 yen taxis on the streets of Tokyo never recovered, and they were just the key customers of whisky.

Therefore, Japanese whisky was first severely attacked by soju and Solvay, and then experienced the low tide of consumption of the core audience. In the case of shrinking market year after year, any Japanese winery had to reduce its production. That’s why Karuizawa, which had great potential in 2000, had to be shut down, and why there were only nine whisky breweries left in Japan by 2010, showing the monopoly pattern mentioned above. Er, is it closed?

05 | epilogue

YCCHUHAI

So, after all, we string together four elements: the value of Japanese whisky comes from market consensus, and the establishment of market consensus depends on a series of infectious narratives. The design and promotion of these narratives need the banker, and the banker needs the hot money to carry the sedan chair to tell the story, and the hot money is willing to enter the market because of the objective scarcity of this asset.

But it is hard to say whether this logic can continue in the future.

Around 2016, the surge in Japanese whisky exports stimulated the old wineries to put into production and the new wineries to enter. By 2020, the Japanese prestige factory has more than doubled, and the supply and demand relationship in the next five years and ten years is not optimistic even for the sellers themselves, like the whisky fund mentioned earlier. It was liquidated in September last year.

What’s more, whether it is because of the recognition of the so-called exquisite and elegant taste of Riwei, or because of its increase in the auction market, people are scrambling to pursue Japanese whisky, which is essentially based on a constructed dream. Luxury goods are a business selling dreams, which makes buyers think that tasting Japanese whisky is to feel exquisite Japanese culture, experience elegant life and have the possibility of getting rich overnight.

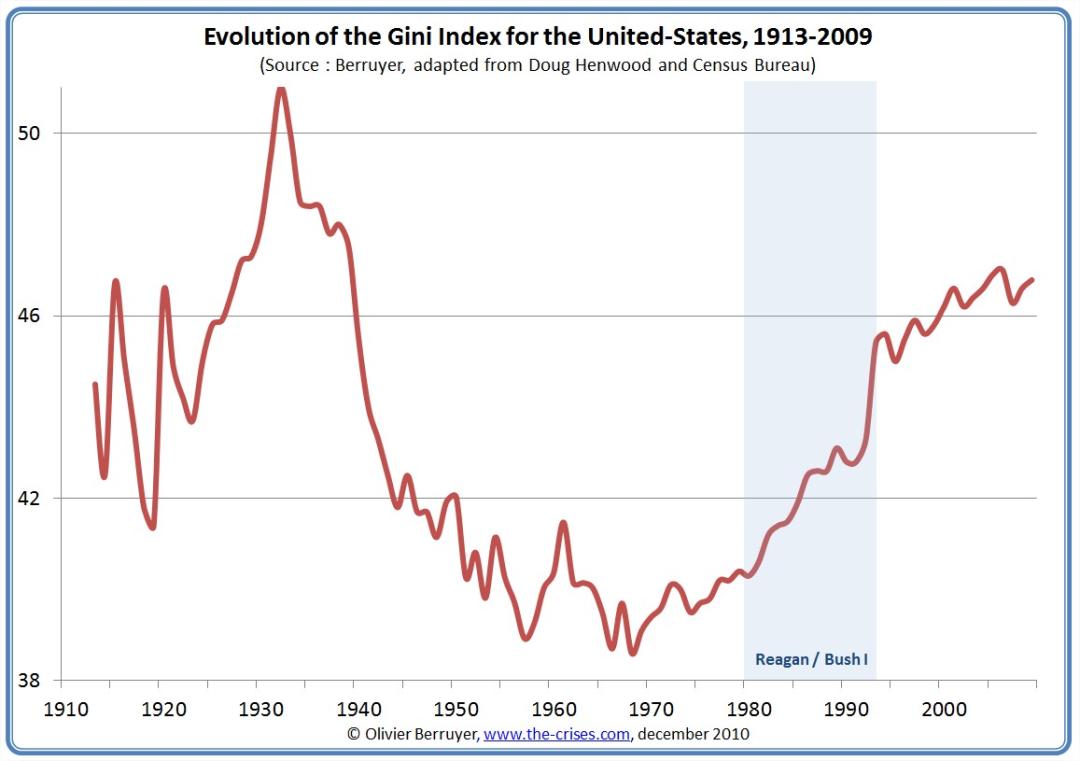

However, in the epidemic that lasted for two years, the global GDP growth rate fell to the bottom. As a result, 100 million people have fallen into extreme poverty, but the net assets of global billionaires have increased by 3.6 trillion euros with the monetary easing of various countries, and the gap between the rich and the poor has widened rapidly.

▲ "Billionaires’ wealth ratio surged during the epidemic"

The last time the same situation happened was in the United States in the 1990s. After the Gini coefficient soared to 0.43, only a quarter of the people in the United States in 1996 believed that life would be better in the future, and the consciousness of rational consumption recovered accordingly. The number of rich careerists on which the luxury goods industry depends has been greatly reduced, so it has been greatly affected.

▲ In the early 1990s, the polarization between the rich and the poor in the United States was sharp.

Then, when this round of economic recession and the tide of widening gap between the rich and the poor are reopened, who should luxury goods sell their dreams to? Can Japanese whisky piled up by dreams continue the myth of growth?

▲▲▲▲▲

Author/Zhou Xueling

This is the 187th original content of Yuanchuan’s research on going to sea.

Original title: "How much Japanese whisky do you drink to pay for marketing costs? 》

Read the original text