On the evening of December 12th, WANDA CINEMAS officially announced that it was no longer Wang Jianlin’s company.

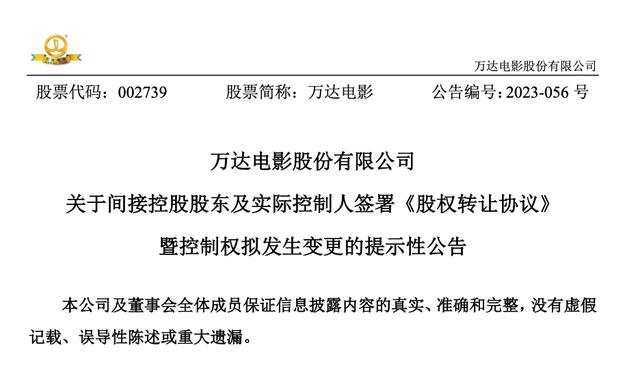

WANDA CINEMAS Co., Ltd. (hereinafter referred to as "the company" and "WANDA CINEMAS", 002739) announced that Beijing Wanda Cultural Industry Group Co., Ltd. (hereinafter referred to as "Wanda Cultural Group"), its wholly-owned subsidiary Beijing Hengrun Enterprise Management Development Co., Ltd. (hereinafter referred to as "Beijing Hengrun"), the actual controllers of the company Wang Jianlin and Shanghai Ruyi Investment Management Co., Ltd. (hereinafter referred to as "Ruyi Investment").Signed the Equity Transfer Agreement,It is planned to transfer 51% equity of Wanda Investment, the controlling shareholder of the company, to Ruyi Investment, with a total transfer price of 2.155 billion yuan.If the above matters are finally implemented,The actual controller of the company was changed to Ke Liming. The company’s shares have resumed trading since the market opened on December 13th, 2023.

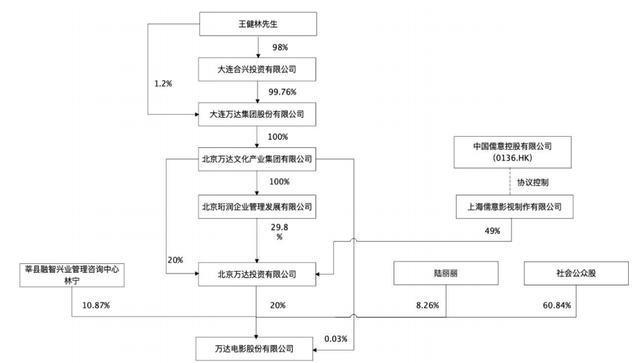

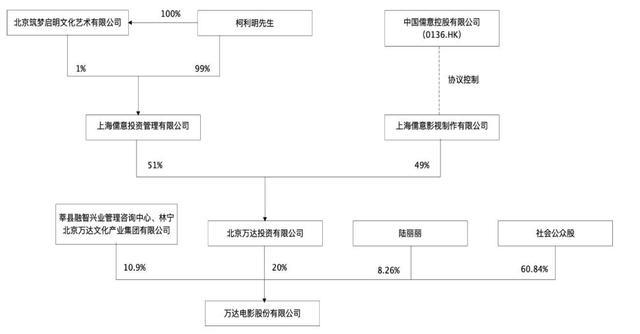

According to public information, China Ruyi (HK0136) controls its subsidiaries by agreement, and the latter holds 100% of the actual rights and interests of Shanghai Ruyi, and Ke Liming, Chairman of the Board of Directors of China Ruyi, holds 99% of the shares of Shanghai Ruyi.

China Confucianism was originally named "Hengteng Network", which was composed ofEvergrandeJointly funded with Tencent, afterEvergrandeIn November 2021, Tencent withdrew its capital, and then became the major shareholder of China Confucianism and Italy through three rounds of additional issuance. At present, Tencent Holdings (0700.HK) holds 19.12% shares of China Ruyi through its wholly-owned subsidiary Water Lily.

The withdrawal of real estate leaders from film and television investment and the takeover of Internet giants are also regarded by the industry as a landmark acquisition event in China cinema industry. In the film and television drama industry, China Confucianism and Italian film industry as the main body, to carry out related business development. Although it is not well-known outside the film and television industry, Confucianism and Italian Film also participated in the production of popular films such as "To the Youth We Will Die", A Little Red Flower and Moon Man.

WANDA CINEMAS: Actual controller.

Will be changed to keliming, and the stock will resume trading.

On the evening of December 12, WANDA CINEMAS announced that the company had recently received a notice that Wanda Culture Group, Beijing Hengrun and Mr. Wang Jianlin signed the Equity Transfer Agreement with Ruyi Investment, which they intend to hold respectively.Wanda Investment holds 20%, 29.8% and 1.2% equity (holding 51% equity of Wanda Investment in total).Transferred to Confucianism and Italy, the total transfer price is 2.155 billion yuan.

After this transaction, the controlling shareholder of the company is still Wanda Investment, and Ruyi Investment holds 51% equity of Wanda Investment. Ruyi Investment is a wholly-owned company of Keliming.Ke Liming indirectly controls 20% of WANDA CINEMAS’s equity through Confucianism and Italian investment, and the actual controller of the company will be changed to Ke Liming.The company’s shares will resume trading on Wednesday, December 13, 2023.

Before this transaction,Wanda Investment, the controlling shareholder of the company, holds 20% of the company’s shares, Wanda Culture Group, Beijing Hengrun,Wang Jianlin holds a total of 51% of Wanda Investment.Wang Jianlin indirectly controls 30.9% equity of WANDA CINEMAS through Wanda Investment and its concerted actors Wanda Culture Group, Shenxian Rongzhi Xingye Management Consulting Center (Limited Partnership) and Lin Ning.The actual controller of the company is Wang Jianlin.

Mr. Ke Liming holds 16.34% of the total share capital of China Ruyi Holdings Co., Ltd. (hereinafter referred to as "China Ruyi"), and China Ruyi controls Shanghai Ruyi Film and Television through an agreement.Production Co., Ltd. (hereinafter referred to as "Ruyi Film and Television") holds 49% equity of Wanda Investment.

After this transaction, the controlling shareholder of the company is still Wanda Investment, and Ruyi Investment holds 51% equity of Wanda Investment. Ruyi Investment is a wholly-owned company of Keliming, who indirectly controls 20% equity of WANDA CINEMAS through Ruyi Investment.The actual controller of the company will be changed to Ke Liming.

In addition, China Ruyi Film and Television, which is controlled by Ruyi through an agreement, holds 49% of Wanda Investment, and Ke Liming also holds 16.34% of the total share capital of China Ruyi. After this transaction, Wang Jianlin indirectly controls 10.9% equity of WANDA CINEMAS through Wanda Culture Group, Shenxian Rongzhi Xingye Management Consulting Center (Limited Partnership) and Lin Ning.

After the completion of the 51% equity transfer, it can be said that Wang Jianlin cleared all the equity of Wanda Investment he held. This is undoubtedly a major turning point for WANDA CINEMAS.

An internal employee of WANDA CINEMAS told the reporter of national business daily on the phone earlier that in October this year, the administrative director and financial director sent by China’s Confucianism and Italy took the lead to settle in WANDA CINEMAS, but other businesses have not changed significantly at present. "As a terminal, even if there is a change, there will be a lag, or the impact is not so great."

Wang Jianlin once made no secret of his ambition for the cultural industry. Many years ago, when faced with the news that Disneyland had settled in Shanghai, he boldly declared that it would be difficult for Disney to make a profit in the next 20 years. He clearly realized that China’s real estate industry has developed for more than 20 years, and in another 15-20 years, this industry may gradually shrink. In order to ensure the sustainable development of Wanda, he understands that the company must turn to diversified fields such as culture and tourism.

In order to realize this transformation, Wanda carried out a major overseas merger and acquisition as early as 2012, and acquired AMC Entertainment Holding Company, the second largest cinema in the United States, which was the first overseas merger and acquisition in China film history. Since then, Wanda Cinema has successively launched a fixed-income plan since July 2015, and plans to acquire 100% equity of Hoyts, the second largest cinema in Australia, and 100% equity of Muwei Fashion and Chongqing Shimao Cinema Management Company, a domestic film data company.

Wanda also owns its own listed company, wanda cinema line, which is in the leading position in the domestic industry and is regarded as an important quality asset of Wanda Culture Group by the outside world. However, affected by the epidemic situation in recent years and other factors, WANDA CINEMAS has also experienced some difficulties. According to the financial report data, in 2019 and 2020, the company lost 4.729 billion yuan and 6.669 billion yuan respectively. Although it achieved a slight profit in 2021, it fell into a loss again in 2022, with a net profit loss of 1.923 billion yuan.

The above-mentioned employees in WANDA CINEMAS told reporters that in recent years, the benefits of Wanda Real Estate have been sluggish, and they often need the support of business management and cultural groups.

Today, Wang Jianlin bid farewell to the original film and television dream.

"Before the epidemic, Wang Jianlin expressed his dissatisfaction with WANDA CINEMAS at the year-end summary meeting for two consecutive years. After the annual party, he will come to our floor, which impressed me deeply. He said in a bad tone that the cinema earned less and the company didn’t keep idle people. The film industry as a whole is only tens of billions a year, which can’t help the big group. " The employee recalled Wang Jianlin’s deep impression on the film and television business.

Who’s Cleming?

Who’s Cleming?

Born in April 1983, Ke Liming is a layman in the film industry. After graduating from abroad, he entered the investment bank. However, after the financial crisis, Ke Liming decided to start a business and began to invest in film and television.

The magical divine comedy "Little Apple" was once a smash hit, and the trader behind it was Ke Liming, and "Little Apple" was also the propaganda song of the film "The Old Boy Raptors Crossing the River" that he was the owner of the real controller.

As an investor and producer, Mr. Ke Liming once led and invested in films such as Keep You Safe, Exchange Life, Moon Man, Hello Li Huanying, A Little Red Flower, Animal World, Sewing Machine Band, never gone, To Our Dying Youth and so on, as well as Love at Nine Bends, Old Chinese Medicine Doctor, Old Tavern, Frontier of Love, No War in Beiping and Langbang.Among them,Guaranteed issueHi, Mom,Won 5.414 billion domestic box office, ranking third in the film history.

This year’s summer file exploded the movie "She Disappeared", and Confucianism and Italian film and television also participated in the investment. The box office of the film has reached 3.467 billion yuan. In addition, this year’s main films of the company include "Warmth" and "Keep You Safe".

At present,ColiminHe is the executive director and chairman of China Ruyi and the executive president of Pumpkin Films Limited.What he is in charge ofmiddlecountryConfucianism(Formerly known as "Hengteng. com"Complex "),frontAs a Masge setGroup, mainly engaged in investment and trading of securities, providing financing, property investment and manufacturing and selling photographic products and accessories business.

In 2015,EvergrandeAfter the acquisition of the group, the Group and Tencent Holdings changed its name to Hengteng Network Group. At that time, the company was mainly engaged in Internet business.

On October 26, 2020, Hengteng Network announced that it had wholly acquired the entire equity of Ruyi Film and Pumpkin Film through allotment and issuance of shares and subscription of equity, and made a comprehensive transformation to an Internet technology enterprise, focusing on creating streaming video services; In January 2021, Hengteng Network announced that it had officially completed the acquisition of all the shares of Confucianism, Italian Film and Pumpkin Film. In the second half of 2021, Evergrande Group experienced a liquidity crisis. By November 2021, Evergrande cleared its equity in Hengteng Network and left, and Ke Liming, the real controller of Ruyi Film, became the largest shareholder of Hengteng Network. Tencent Holdings became the second largest shareholder. After Evergrande left, Hengteng Network was officially renamed as "China Confucianism" in February 2022.

On July 4th, 2023, China Confucianism announced that the company had entered into a share subscription agreement with the subscribers, and issued a total of 2.5 billion subscription shares at a price of HK$ 1.6 per share, raising a net fund of HK$ 4 billion. The institutions or individuals participating in this subscription include Tencent, Liu Xueheng, Cubract Ventures, Yushan and Chengwan Development.

Among them, Tencent will take out 800 million Hong Kong dollars to participate in the subscription through its subsidiary Water Lily, and after the transaction is completed,Ke Liming, chairman of China Ruyi, will reduce his shareholding in China Ruyi to 15.14%.Tencent’s shareholding ratio through Water Lily increased to 20.36%, further consolidating its position as a major shareholder.In addition, Liu Xueheng holds 4.29%, Cubract Ventures holds 4.36%, and Yushan and Chengwan Development hold 4% respectively. According to China Confucianism, the HK$ 4 billion fund obtained this time, of which HK$ 3.6 billion is intended to be used for the development and expansion of the group’s film and game business, and HK$ 400 million is used for the general working capital of the group.

Shanghai ConfucianismA controlled structural entity holding 100% actual rights and interests for China Confucianism and Italy, whichFounded in 2013, it is mainly engaged in the production and operation of radio and television programs and film distribution business.

Wanda’s 38 billion yuan gambling crisis was lifted

Wanda’s 38 billion yuan gambling crisis was lifted

According to Dalian Wanda official website, on December 12, 2023, PAG and Dalian Wanda Commercial Management Group jointly announced the signing of a new investment agreement. Taimeng will cooperate with other investors to reinvest in Zhuhai Wanda Commercial Management after its investment redemption expires in 2021 and is redeemed by Dalian Wanda Commercial Management Group. In August 2021, the existing investors invested about 38 billion RMB in Zhuhai Wanda Commercial Management, of which the investment of Taimeng was about 2.8 billion US dollars (about 18 billion RMB), and the existing investors enjoyed the right of redemption at maturity in the original investment arrangement.

This means that before the deadline for Zhuhai Wanda Commercial Management to go public in Hong Kong comes, the gambling pressure on Wanda’s listing has been eliminated.

According to the information disclosed in the previous prospectus, there are 22 institutional investors of Zhuhai Wanda Commercial Management, including Zheng Yutong Family, Country Garden, CITIC Capital, Ant, Tencent and Taimeng Investment Group. In August 2021, these investors invested about 38 billion RMB, of which Taimeng invested about 2.8 billion US dollars (about 18 billion RMB). According to the contents of the previous gambling agreement, if Zhuhai Wanda Commercial Management fails to complete the listing before the end of 2023, Wanda Commercial Management is obliged to repurchase shares from the above investors. If Zhuhai Wanda Commercial Management cannot be listed at the end of this year, it will trigger a repurchase agreement, and Wanda’s cash flow may also be under pressure.

According to the new agreement, Dalian Wanda Commercial Management Co., Ltd. holds 40% of the shares, which is the single largest shareholder, and several existing and new investors such as Taimeng participate in the investment, holding a total of 60%. Previously, Dalian Wanda Commercial Management directly owned about 69.99% of the total issued shares of Zhuhai Wanda, and indirectly owned about 8.84% of the total issued shares through Zhuhai Wanxin, Zhuhai Wanying and Yinchuan Wanda; Twenty-two companies and six senior executives hold shares, holding 21.15% of the shares.

In other words, after the signing of the new agreement, the shareholding ratio of Dalian Wanda Commercial Management Group in Zhuhai Wanda Commercial Management Group decreased by at least 29.99%, while the shareholding ratio of the aforementioned investors increased by 38.85%.

According to Blue Whale Finance, Zhuhai Wanda Commercial Management Co., Ltd. will mainly introduce foreign investors, and some of the original domestic investors will withdraw. Another investor of Zhuhai Wanda Commercial Management Co., Ltd. also said that at present, the investors of Zhuhai Wanda Commercial Management Co., Ltd. are indeed overseas investors, but the list of new investors has not been completely determined. Regarding whether Zhuhai Wanda Commercial Management Association will redeem the investment on schedule when it expires, the above investors said, "After Zhuhai Wanda Commercial Management has talked with the new investors, it is expected that there will be a transitional stage for the withdrawal of the original war investment, and the process is more complicated. At present, all parties are discussing."

According to china securities journal, people close to Wanda responded by signing a new agreement. Some existing investors chose to withdraw from the investment, but the vast majority of investors kept their investment in Wanda. More importantly, new investors entered, including some overseas investors, which showed that investors highly affirmed the growth potential of Zhuhai Wanda Commercial Management and its operating ability.

Zhuhai Wanda Commercial Management signed a gambling agreement with investors. First, the actual net profit from 2021 to 2023 should not be less than 5.19 billion yuan, 7.43 billion yuan and 9.46 billion yuan, otherwise Wanda Commercial Management will transfer the relevant number of shares at zero consideration or pay cash compensation; Second, it will be listed in 2023 at the latest, otherwise Wanda Commercial Management will buy back shares from investors and pay extra compensation.

According to the performance data disclosed by Wanda, Zhuhai Wanda Commercial Management has exceeded its performance target for three consecutive years, with after-tax income of 23.5 billion yuan in 2021, 27.1 billion yuan in 2022 and 29.3 billion yuan in 2023 (estimated), with an average annual growth of about 12%; After-tax profit is 5.3 billion yuan in 2021, 7.5 billion yuan in 2022 and 9.5 billion yuan in 2023 (estimated), with an annual growth rate of 34%.

According to the interim report of Wanda Commercial Bond (2023), the company’s interest-bearing debts within six months totaled 15.84 billion yuan. In other words, Wanda Commercial Management still has 15.84 billion yuan of interest-bearing debt due during the year. The above report also shows that Wanda Commercial Management’s interest-bearing debt due in the first half of 2024 is 13.417 billion yuan.

According to the 2023 Hurun Rich List released by Hurun Research Institute on October 24th, the Wang Jianlin family of Wanda was among the richest people with the largest decline in wealth this year, and its wealth dropped by about 53 billion yuan.

edit|Du Hengfeng Du Bo, Cheng Peng

Cover Image Source: vision china

National business daily is integrated from company announcements, Blue Whale Finance, china securities journal, Wanda official website and public information.

Who’s Cleming?

Who’s Cleming?